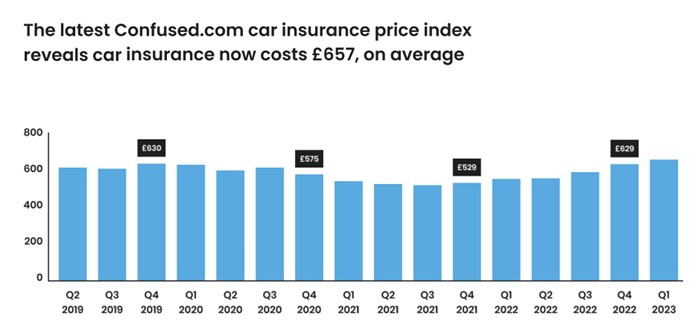

Powered by WTW, recent research from the Confused.com car insurance price index indicates that auto insurance costs an average of £657 in the UK. This pertains to the first quarter of 2023. The highest prices in the last 12 years have risen by £107 (20%) in the past 12 months.

Confused.com and WTW car insurance price index started in 2006, and it is the most detailed analysis of auto insurance premiums in the UK. In order to provide market information and analysis, the index, which is issued every quarter, analyses more than 6 million automobile insurance quotes each quarter.

Prices have risen above pre-Covid numbers. Prior to falling the next quarter, prices peaked during the pandemic at £630. Less traffic and the resulting decline in claims were the main causes of this. But as soon as people resumed their normal driving habits, prices started to increase once more.

After a price increase of 4% (£28) in the first quarter of 2023, auto insurance rates have also gone up for six straight quarters. In addition, the UK’s rate of inflation has been over 10% for the past six months and is still very near to a 40-year high. As a result, insurers are being directly impacted by rising expenses that are getting harder to bear, according to WTW.

“Fast-paced inflation throughout the UK economy has driven up the costs insurers face in fulfilling claims, such as rocketing motor repair, parts, and labor prices,” said Tim Rourke, UK Head of P&C Pricing, Product, Claims, and Underwriting at WTW.

The index shows that price hikes have been most harsh for owners of vehicles up to eight years old, who have had yearly increases of more than 20%, with drivers of three-year-old cars experiencing the highest increases of 27%.

In a similar vein, more expensive vehicles have seen far more dramatic price rises over the past year, with yearly increases exceeding 30% for vehicles over £30,000 and reaching a peak of 37% for vehicles over £40,000.

Every location in the UK experienced double-digit price increases for insurance premiums during the previous 12 months. With an annual increase of 23%, drivers in London had the biggest percentage rises in the cost of comprehensive auto insurance.

Within London, the average premium now costs £1067, whereas in Outside London, it costs £845. The South West of England and the Scottish Borders experienced the least annual rises, but drivers there still experienced a hefty annual increase of 16%, with typical premiums now costing £434 and £428 respectively.

The South West of England is still the place to buy cheap vehicle insurance. Meanwhile, the most costly regions outside of the capital continue to be Manchester/Merseyside (£814) and the West Midlands (£787).

The index also noted that premiums for drivers between the ages of 17 and 20 rose at the fastest rate in the past year, with male drivers in that age group seeing a percentage increase of 29% (£437) and female drivers seeing a surge of 30% (£316), bringing their premiums to £1930 and £1360, respectively.