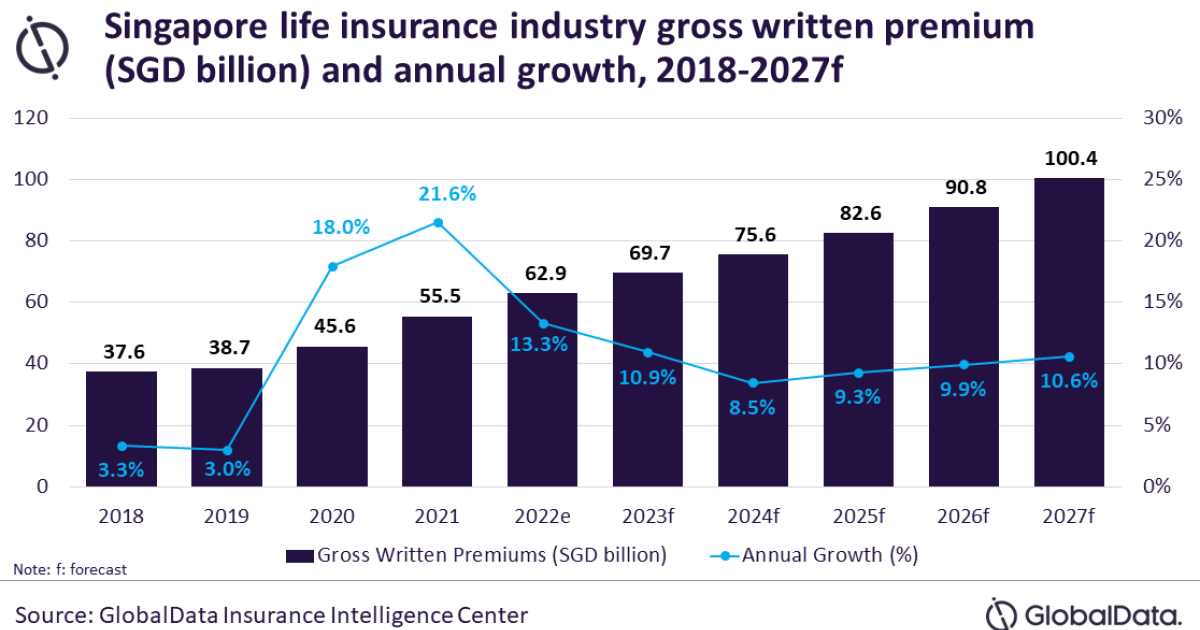

The life insurance market in Singapore will reach S$100.4 billion (£68 billion, $77 billion, or €71 billion) in terms of gross written premium (GWP) by 2027, according to the forecasts of GlobalData.

According to GlobalData, this will result in a 9.8% compound annual growth rate for the industry from its current value of S$62.9 billion.

The Singapore life insurance market expanded 13.3% in 2022, and 10.9% growth is anticipated for 2023, according to GlobalData’s Insurance database.

Increased financial planning awareness following the pandemic will be the main driver of development and an increase in demand for protection products like term and whole life insurance.

With a 50.3% share of the GWP in 2022, whole life insurance is the market sector that held the largest market share in Singapore. In 2022, endowment insurance made up 33.1% of the total life GWP. In 2022, Personal Accident and Health (PA&H) contributed 8.6% of the total life GWP. The remaining 8% of the GWP for life insurance in 2022 was made up of term life insurance as well as other types of life and annuity insurance.

“Despite the pandemic, Singapore’s life insurance industry has shown resilience and recorded its fastest growth in recent years,” said Shabbir Ansari, a senior insurance analyst at GlobalData.

“After experiencing significant growth of 18.0% and 21.6% in 2020 and 2021, respectively, the industry’s growth is anticipated to decrease from 2022 onward due to the world’s decreasing economic development, rising prices, and geopolitical unrest.

“Over the next five years, the Singaporean life insurance industry is anticipated to experience strong growth, supported by rising financial protection awareness, product innovations, and a rising affluent population in the nation.”