The Impact Forecasting section of insurance and reinsurance broker Aon has released a preliminary estimate for insured worldwide catastrophic losses in the first quarter of 2023. The estimate places the total at about $15 billion and identifies strong convective storms as the primary driver.

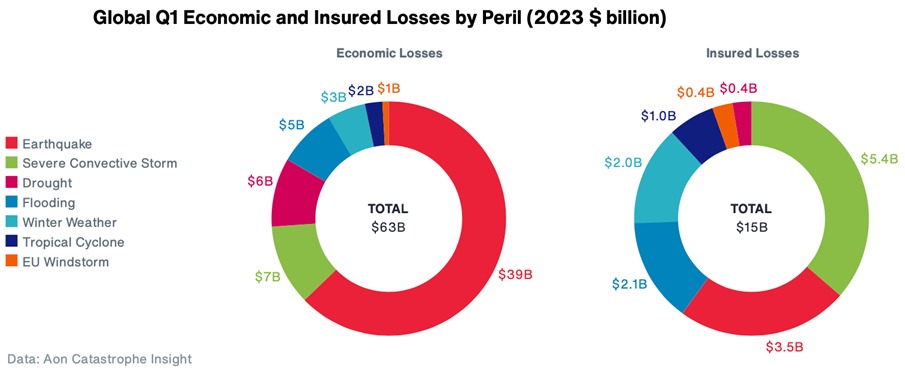

The disastrous earthquake that struck Turkey and Syria is the biggest cause of the financial losses, accounting for almost $39.1 billion of the total.

Aon estimates that in the first quarter of 2023, natural disasters would have cost at least $63 billion in economic losses worldwide. The total economic harm brought on by natural disasters, according to Aon, is much more than the baseline for the 21st Century ($53 billion) and significantly higher than the median ($38 billion).

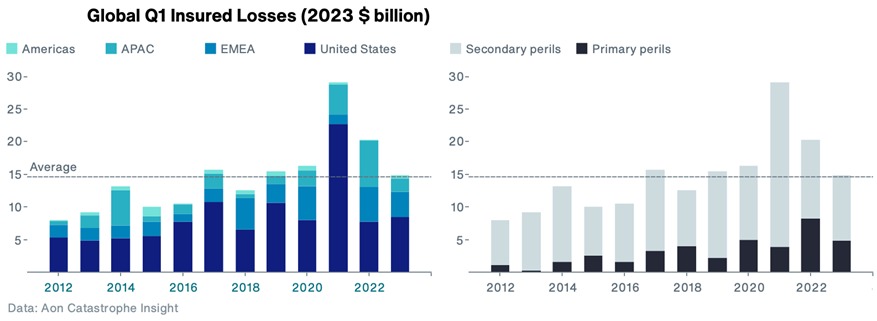

A $15 billion global loss to private and public insurance institutions is now projected, which is similar to both the average and median of the previous ten years.

Aon cautions that anticipated loss developments will probably result in greater insured loss amounts overall. In fact, according to Aon, “robust loss development” from the natural disasters and meteorological catastrophes that were experienced in Q1 2023 is predicted to continue throughout the rest of the year.

As is customary, secondary risks were primarily responsible for the majority of first-quarter insured disaster losses worldwide. According to estimates, 58% of the insured losses were caused by events in the United States, and 25% by those in EMEA.

The earthquake in Turkey and the beginning of severe convective storm activity in the United States on March 1-3, according to Aon, were two more significant events that are each expected to result in insured losses of more than $3 billion. Aon estimated that the combined insured damage from Cyclone Gabrielle and the Auckland flooding would total close to $2 billion after the events in New Zealand.

The US severe convective storm activity is now estimated by Aon to be responsible for insured losses of $5.4 billion, though this number may increase given that part of this activity is recent.

Aon also points out that European Windstorms experienced their least expensive winter since 1995/1996.

It’s important to keep in mind that broker BMS Group predicted significant growth in the overall insured losses from severe convective storms in Q1, with as much as $9.5 billion from that single risk, which would greatly increase Aon’s estimate if it materializes.