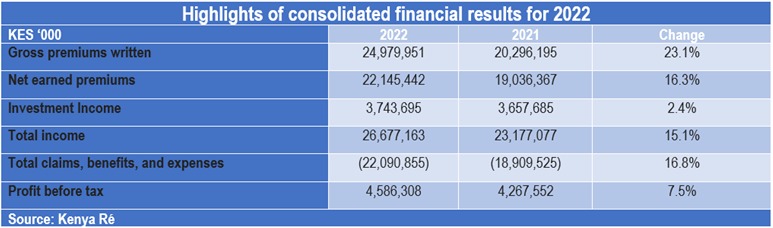

For the fiscal year that concluded on December 31, 2022, Kenya Reinsurance Corporation (Kenya Re) reported a consolidated net profit of KES3.62 billion ($27.5 million), 15% more than the KES3.16 billion reported for the previous year.

Gross written premiums, which increased by 23% annually or KES4.68 billion in absolute terms to KES24.98 billion in 2022, are the cause of the rise in net profit.

Kenya Re attributed the improvement in financial performance, among other things, to the success of its ongoing reinsurance portfolio, diversification, and quick claims processing.

Acting managing director of the reinsurer Michael Mbeshi stated, “We have significantly expanded our business through strategic investments in new business lines and innovation, with the key focus being Kenya and key countries with East, Southern, and Northern Africa setting the stage for the next phase of our strategy.”

As part of Kenya Re’s five-year business plan, non-funded income has been increased and been strengthened by the business sectors of engineering and fire.

According to Kenya Re, the COVID-19 pandemic’s effects on the investment environment led to a 2% increase in investment income to KES3.74 billion in 2022.

Compared to a year earlier, the reinsurer’s asset base climbed by 26% to KES70.13 billion at the end of 2022, which is on the balance sheet. At the end of 2022, the value of shareholder money increased by 10% to KES40.77 billion